|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

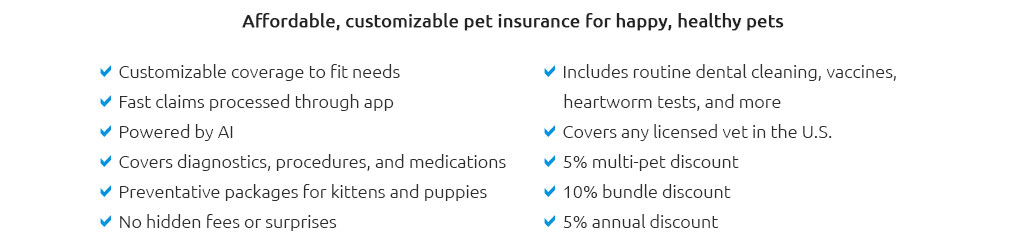

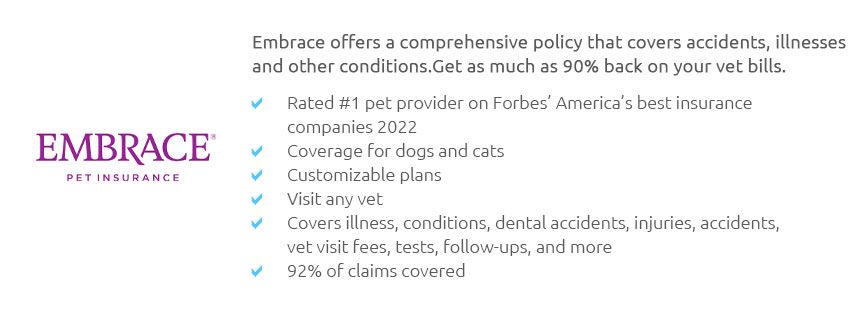

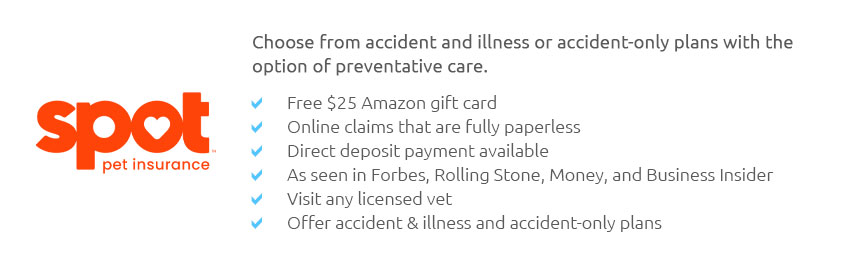

pet medical insurance coverage insights for thoughtful ownersWe've sat in emergency lobbies at 2 a.m., read the fine print, and filed claims. That's the lens we use here: practical, steady, and clear-eyed about what policies actually do - and what they don't. What it is and how it worksMost plans reimburse for accident and illness care. Some offer optional wellness add-ons, but those are budget tools, not true insurance. You pay a monthly premium; when your pet needs care, you submit a claim and get reimbursed based on your chosen deductible, reimbursement rate, and annual limit.

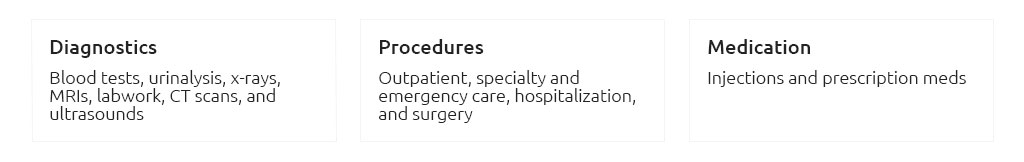

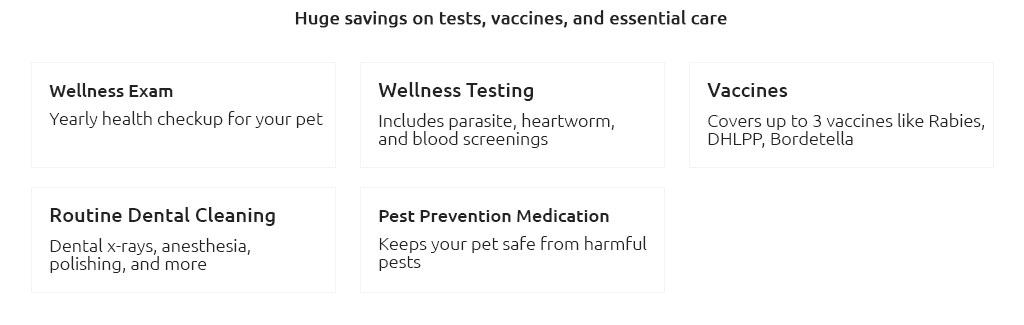

What policies commonly cover

Coverage hinges on medical necessity and documentation from a licensed veterinarian. Keep itemized invoices and diagnosis notes. Common exclusions and tempered expectationsNo policy covers everything. It's better to know that up front.

Costs and what drives themTypical monthly premiums (U.S.) run roughly $35 - $70 for dogs and $20 - $40 for cats for mid-tier options, but location, breed, age, and your chosen deductible/limit shift the numbers. Premiums usually rise over time due to inflation and claims trends; we plan for gradual increases instead of assuming prices will stay flat. Deductibles and coinsurance in practiceExample: $2,800 ACL surgery; $250 annual deductible; 80% reimbursement; $65 exam fee not covered. Eligible costs after deductible: $2,800 − $250 = $2,550. Insurer pays 80% of $2,550 = $2,040. You pay $510 coinsurance + $250 deductible + $65 exam = $825 out-of-pocket. Clear estimates like this help set realistic expectations before care is performed. A grounded, real-world momentLast fall, our cat Miso developed a urinary blockage on a Sunday. We authorized hospitalization immediately; delaying wasn't an option. The invoice came to $1,940. We uploaded the itemized bill and SOAP notes that evening. Nine days later, the claim was reimbursed per our policy terms - helpful, yes - but we still paid the deductible and a portion of the bill. Insurance kept a crisis from becoming a financial spiral, but it didn't erase costs entirely. How to compare policies

Claims and recordkeeping

Puppies, kittens, and seniorsEnrolling early reduces the chance that common issues get labeled pre-existing. Some insurers limit new enrollments above certain ages or require medical records before activation. Seniors can still benefit, but expect higher premiums and more exclusions; plan accordingly. If insurance isn't a fit right nowAlternatives include a dedicated savings account, discussing payment plans with your vet, or exploring nonprofit funds for specific conditions. These can complement a high-deductible policy or stand alone for low-risk pets. Final thoughtsWe value pet medical insurance coverage for unexpected, high-cost events. It won't cover every bill, and reimbursements aren't instant. But paired with good records and a realistic deductible, it can turn an overwhelming emergency into a manageable decision. Measure policies against your pet's risks, your budget, and your tolerance for uncertainty. Quiet preparation beats wishful thinking.

|